There’s no denying the dominance of Google when it comes to search marketing. In October 2022, Google’s market share of search was 91.2%, making it by far the most popular search engine in the world.

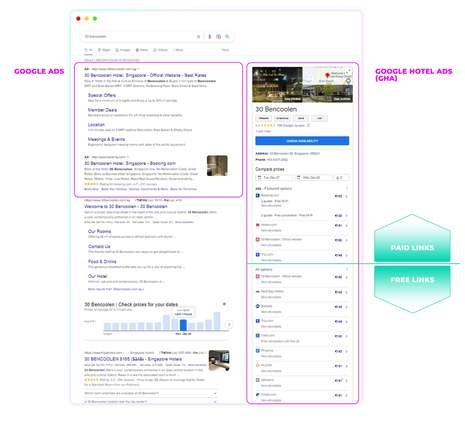

For hotels, Google offers numerous opportunities for reaching the hundreds of millions of travellers who search for hotels on Google every day. One option that has been gaining a lot of traction recently is Google Hotel Ads (GHA), a metasearch platform.

Metasearch platforms like Tripadvisor, Kayak, Trivago and Google Hotel Ads display a hotel’s rate offerings pulled from a variety of booking sources on one page. Travellers love them because they can compare rates without having to visit every site. To make a reservation, users click through to their preferred booking source.

To display a direct link on metasearch results pages for a given hotel, the hotel and online travel agencies must bid for placement and pay a fee for every click. If the hotel doesn’t appear, travellers are more likely to click through to an OTA and book there. Metasearch campaigns are therefore an important way for hotels to attract direct bookings and reduce third-party commissions.

Google launched its metasearch module over ten years ago, giving it high visibility by integrating it into Search, Maps, and Business Profiles. Since then, the platform has been carving an increasing market share from other metasearch sites. In 2021, Google upped its game even further by adding Free Booking Links (FBL) as part of the Google Hotel Ads platform. When a hotel creates a GHA campaign and activates this feature, a free link to its website booking engine is displayed alongside paid ads in the metasearch module.

At D-EDGE, we’ve always recognised the value of Google metasearch, but even we were surprised by the results. Free Booking Links are a game-changer for hotels. Here are five key takeaways from our findings.

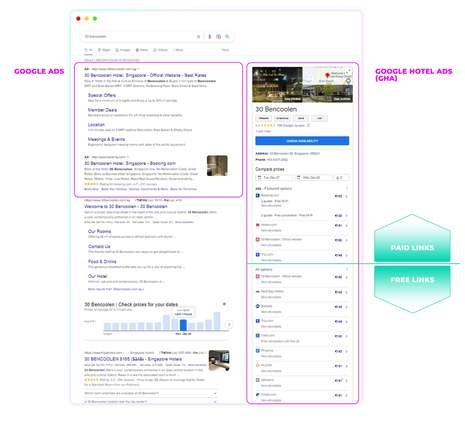

While revenue generated from Google Ads (Ad words) grew by 20% between 2019 and 2022, incredibly hotels experienced an average increase in revenue of 95% from Google metasearch(Google Hotel Ads).

Free Booking Links accounted for an impressive 34% of this revenue, whereas the paid part of Google Hotel Ads accounted for 66%, increasing by 29% over 2019.

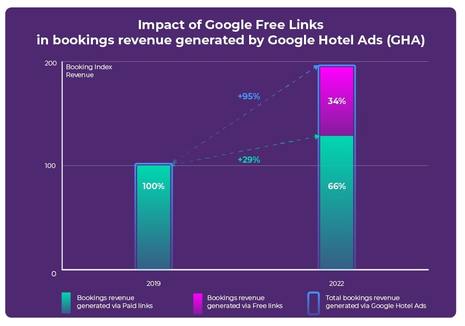

In 2022, the average distribution cost for bookings from Google Hotel Ads paid links was 8% of revenue generated, a decrease from 9% in 2019. However, when Free Booking Links are factored in at zero distribution costs, the average distribution cost dropped to 5.2%.

For Google Ads, the average distribution cost in 2022 was 7%, a decrease from 8% in 2019. On both platforms, pay-per-click fees are considerably lower than OTA commissions, which generally start at 15% on Booking.com and 18% on Expedia plus incremental commissions for promotions.

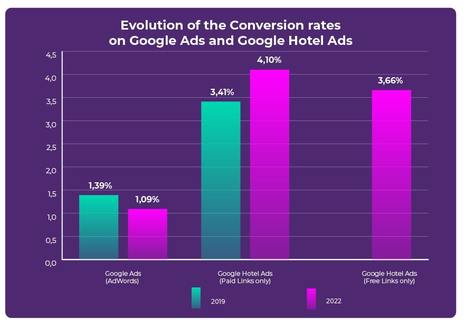

In 2022, the average conversion rate for Google Hotel Ads was 4.10%, an increase from 3.41% in 2019. For Free Booking Links, the average conversion rate was slightly lower at 3.66%. This means that for every 100 users who clicked the free link, an average of almost four of them made a booking.

Given the high volume of traffic Google receives, even a small increment in conversion rates can result in a significant boost in bookings. By comparison, the conversion rate for Google Ads was 1.09%. Metasearch typically generates more conversions because live room rates are displayed, whereas they are not displayed in Google Ads.

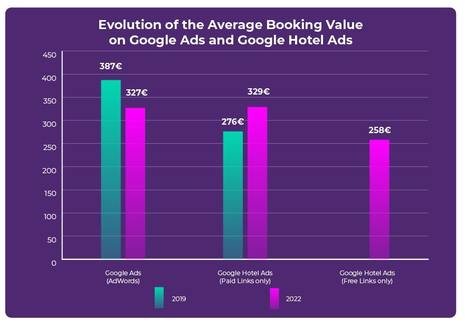

For Google Hotel Ads, the average revenue per booking in 2022 was €329, an increase of 19.2% over 2019. Meanwhile, the average revenue per booking from Free Booking Links was €258 — lower but still significant given there were no distribution costs. For Google Ads, the average revenue per booking was virtually the same as GHA at €327.

The lower average value of FBL bookings can be explained in part by the high proportion of mobile bookings, as we see in the next key finding. Travellers tend to book shorter, last-minute stays on mobile devices and longer stays on desktops.

At 68%, the majority of bookings generated by Free Booking Links came from mobile devices, whereas 32% came from desktops. Almost the reverse was true of Google Hotel Ads and Google Ads, where 37% of bookings were made on mobile devices and 63% on desktops.

The difference can be explained in part by the high visibility Google gives to Free Booking Links on smartphones. On desktop searches, FBLs are harder to find and sometimes didn’t appear at all during our testing.

Although overall revenue generated by Google Hotel Ads increased substantially in 2022, it’s clear that Free Booking Links are cannibalising some of Google’s cost-per-click revenue. Which begs the question, why does Google give away these clicks for free?

While Google hasn’t provided an explanation, we suspect it’s part of a “freemium model” strategy — providing a basic product or service free of charge to attract new customers, knowing that some will pay for additional or premium services.

To activate Free Booking Links, hotels must launch and maintain an active Google Hotel Ads campaign. Some hotels set the minimum bid to ensure their ads never show up. Others, however, decide to invest in a paid campaign, putting more revenue into Google’s pockets. And in the future, if Google discontinues free links, hotels will have to run paid GHA campaigns if they wish to continue driving direct bookings on the platform.

Here are a few more things to know to activate your free link.

The bottom line? “Metasearch has become an integral part of a diverse distribution strategy for hotels,” says Hadrien Lanne, D-EDGE’s Digital Media Director. “If hotels aren’t participating in metasearch, they’re losing direct bookings to OTAs and paying commissions of 15 to 20%. With Google’s Free Booking Links, hotels now have a way to increase direct bookings at a lower cost. It’s a win-win for hotels.”

D-EDGE is a SaaS company offering leading-edge cloud-based e-commerce solutions to more than 17,000 hotels in over 150 countries. Combining technical excellence with digital marketing expertise, D-EDGE brings a holistic hospitality technology infrastructure under one roof. The integrated range of solutions covers all stages of hotel distribution which encompasses Central Reservation System, Guest Management, Data Intelligence, Connectivity Hub, Digital Media, and Website Creation. With a team of 500 experts located in over 25 countries, D-EDGE provides localised support, services, and tools. With its global network of 550+partners, D-EDGE’s ever-expanding ecosystem is a positive place to do business and grow. D-EDGE is a subsidiary of Accor, a world-leading hospitality group consisting of more than 5,300 properties and 10,000 food and beverage venues throughout 110 countries. For more information visit www.d-edge.com.

Organization

D-EDGE Hospitality Solutions

https://www.d-edge.com/

64-66, Rue des Archives

Paris, 75003

France

Phone: +33 (0)1 8721 3940

Email: communication@d-edge.com

Recent News

How to prevent hotel no-show and last-minute cancellations? How to prevent hotel no-show and last-minute cancellations? |

The GDS: A High-Performing Distribution Channel Too Many Hotels Overlook The GDS: A High-Performing Distribution Channel Too Many Hotels Overlook |

The EU Digital Markets Act (DMA) is changing Google Search, but not how hoteliers had hoped The EU Digital Markets Act (DMA) is changing Google Search, but not how hoteliers had hoped |